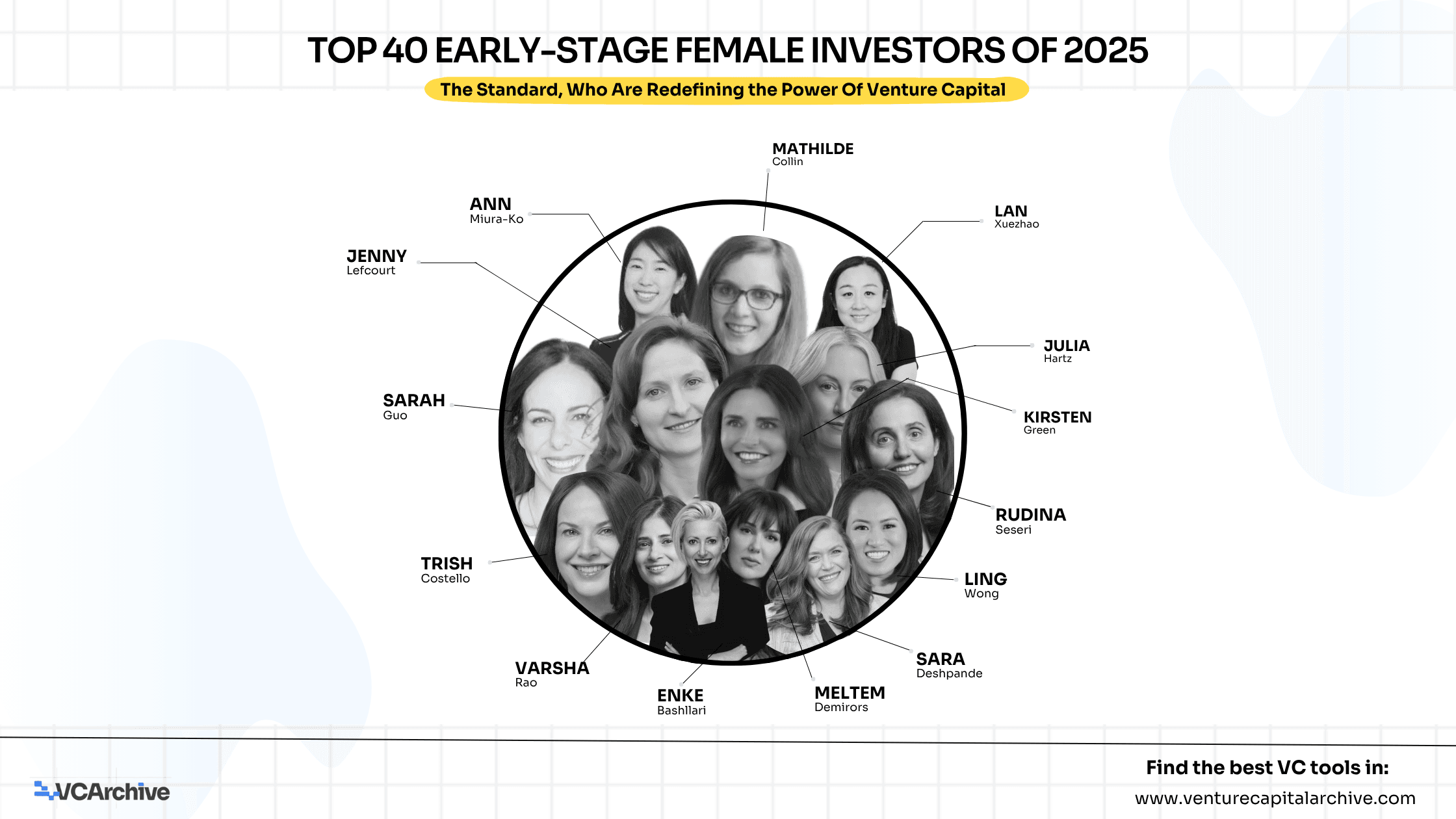

Top 40 Early-Stage Female Investors of 2025

These women are not just participating, they are leading. And in doing so, they are advancing a more inclusive, performance-oriented, and mission-aligned future for venture capital.

Key Characteristics Defining This Cohort

Strategic Focus

Most operates between Seed and Series A, targeting high-leverage entry points where smart capital and operational support make the greatest difference.

Sector Specialization

There is a strong concentration in SaaS, AI, digital health, fintech, marketplaces, and climate innovation. Many focus on specific verticals that align with personal expertise and conviction.

Operator DNA

Many bring founder or executive experience, allowing them to offer more than capital, from go-to-market strategy to hiring, product, and positioning.

Values-Driven Capital

These investors often align their theses with broader missions such as empowering underrepresented founders, advancing sustainable technologies, and improving health outcomes.

Global Perspective

Though many are based in the United States, their investment activity spans Latin America, Europe, Asia, and Africa, reflecting a global outlook and impact.

Collaborative by Nature

They frequently participate in co-investments, syndicates, and community-led initiatives, strengthening the connective tissue of the early-stage ecosystem.

The VC industry is evolving and these women are leading that evolution. They’re writing the first checks for tomorrow’s unicorns, creating more inclusive cap tables, and showing that performance and representation are not at odds.

This isn’t a diversity initiative. It’s a new standard for venture capital.

Explore the full list of 40 Women Who Are Redefining the Power of Venture Capital

Now live on VCArchive, including their sector focus, fund size, and global headquarters.

Top 40 Early-Stage Female Investors of 2025